WEEK 96: LPG Insider Report

In the immediately preceding week, there were imbalances in the prices of the foreign market while domestic prices for LPG continue to rise

In the immediately preceding week, there were imbalances in the prices of the foreign market while domestic prices for LPG continue to rise

In the immediately preceding week, there were imbalances in the prices of the foreign market while domestic prices for LPG continue to rise

![]()

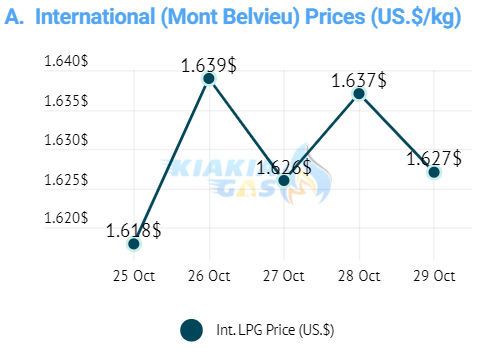

The international prices of LPG in the previous week continued to fluctuate from the beginning till the end of the week.

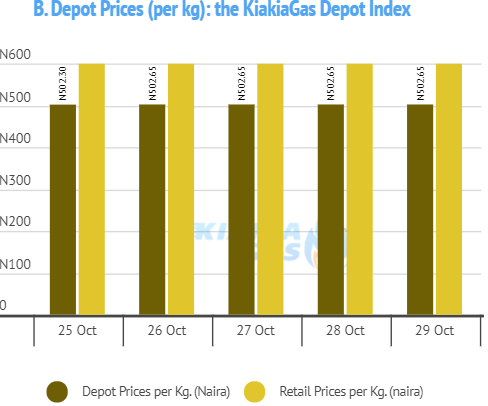

Depot prices continue to increase throughout the week compared to the previous week.

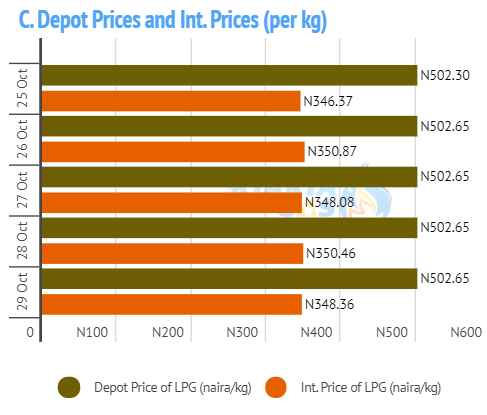

Despite a somewhat higher price in foreign markets price, the price gaps between prices at the depot level and those at the international level have remained consistent.

In the week under review, the price continues to increase per kg of LPG and has been trading for the past 8 weeks.

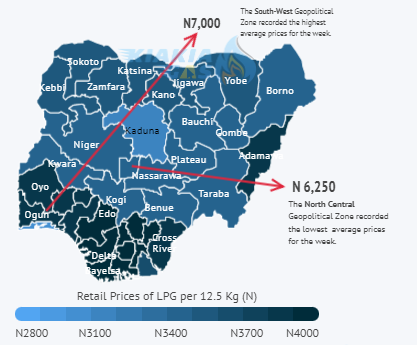

Due to transportation costs and proximity to the coast, disparities in LPG retail pricing still exist across the country.

![]()

A daily feature of the Nigerian LPG market was regional variance in LPG prices across the country. Because of the in price speculation and living style, the LPG South-West region has the highest price.

![]()

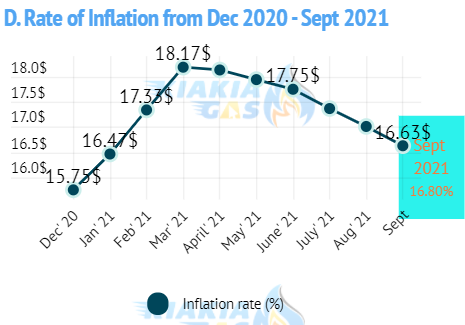

Inflation Rate and the LPG: Over the last 5 months, the rate of inflation has been steadily decreasing. It fell from 17.01% in August to 16.63% in September 2021. The anticipated inflation rate for the month of September is 16.80%. The monetary measure put in place by the monetary authorities contributes to the fall in the rate of inflation trend. The composite food index reduced to 20.3% in August 2021 from 21.03% in July. It was 22.95% in March 2021 to 22.72% in April 2021, 20.57% in January 2021, 19.56% in December 2020, 15.48% in July 2020 compared to 15.18% in June 2020.

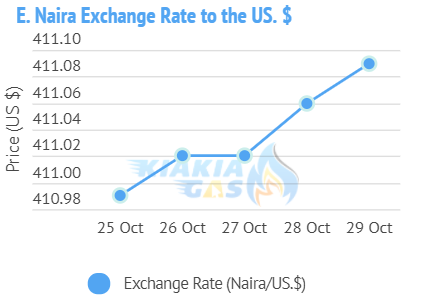

Exchange Rate and the LPG: The exchange rate continues to rise despite a level range at the middle of the week. It rose from 410.99 to 411..09 in the week due to the adjustment made by the CBN to stabilize the naira against the dollar. The exchange rate is one of the factors that influence LPG prices on the international market. A higher exchange rate would boost the price of LPG on the local market by a considerable amount. This means that the LPG market is in a state of flux, Figure E.

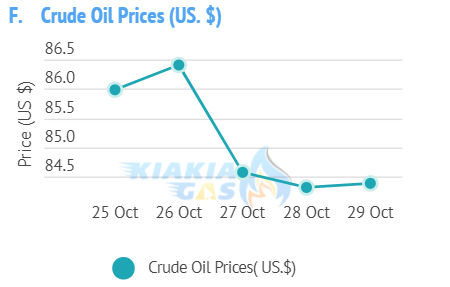

Crude oil price and the LPG: The relationship between LPG price and crude oil price remains positive, as a by-product of crude oil. Crude oil prices sloped downward after an initial increase during the week. (Figure F). This shows that the price of crude oil has not been stable in the international market. This reflects variability in the market price for LPG.

Foreign Reserves: As in the previous week, the Nigerian Gross Foreign Reserve increased slightly from $41.12 billion to $41.59 billion. This is due to an increase in the price of oil and assistance from external creditors to grant loans for infrastructure development.

PMI: The CBN Purchasing Managers Index (PMI) recorded overall growth in employment, business and inventory in the month of December while ordering in the category of supply for power, gas, steam and air conditioning remained stagnant while business operation & inventory were static in the same month at 45.7 per cent.

![]()

Covid-19: Covid-19 causes demand for goods and services to fall due to the full or partial lock-down effect. The implication of the Covid-19 contracts to the LPG market

![]()

Reducing the effect of the Covid-19, entails more campaign and public awareness of the virus as people are easily carried away and relaxing. Vaccines for Covid-19 should be distributed without much delay if available.

![]()

The prices in the weeks to come may rise due to the effect of an increase in the LPG price level from depot even though the month-on-month rate of inflation is reducing.

The Nigerian LPG market is the next success story of the Global LPG industry, if you need a partner with a global perspective and local expertise in the Nigerian and African space, kindly book a free session with our team of experts to help you http://www.kiakiagas.com/book-session or write us an email at advisory@kiakiagas.com or Whatsapp: +2348085269328